In the ever-evolving landscape of travel, frequent flyers and occasional vacationers alike have increasingly turned to loyalty programs and credit card rewards to subsidize their journeys. As the use of points and miles becomes more prevalent in booking flights, accommodations, and other travel-related services, a pertinent question arises: Are travel insurance policies reliable when these trips are funded with points? This inquiry delves into the intricate relationship between travel insurance and reward-based travel, examining the coverage nuances, potential pitfalls, and considerations travelers must keep in mind. By analyzing policy details, industry practices, and real-world scenarios, this article aims to provide a comprehensive understanding of the reliability and effectiveness of travel insurance in the context of points-based travel, equipping readers with the knowledge needed to make informed decisions.

Understanding Travel Insurance Policies with Reward Points

With the rise of travel rewards programs, many travelers are finding themselves with an abundance of points that can be used for a variety of travel-related expenses, including insurance. Travel insurance policies acquired through reward points can offer an appealing solution, but it’s crucial to analyze their reliability. While these policies may seem convenient and cost-effective, they often come with certain limitations. For instance, coverage options might be restricted compared to standard policies purchased directly with cash.

- Limited Coverage Options: Reward point policies might not cover all types of travel risks, such as extreme sports or high-risk activities.

- Claim Processing: The process for filing claims could be more complex or slower compared to cash-purchased policies.

- Policy Restrictions: Some reward-based policies may have stricter terms and conditions, potentially leading to unexpected out-of-pocket expenses.

Therefore, while using reward points for travel insurance can be a smart way to save money, it’s essential to thoroughly review the policy details and ensure it meets your travel needs. Consider the trade-offs and evaluate whether the convenience and savings outweigh the potential limitations.

Evaluating the Reliability of Points-Based Travel Insurance

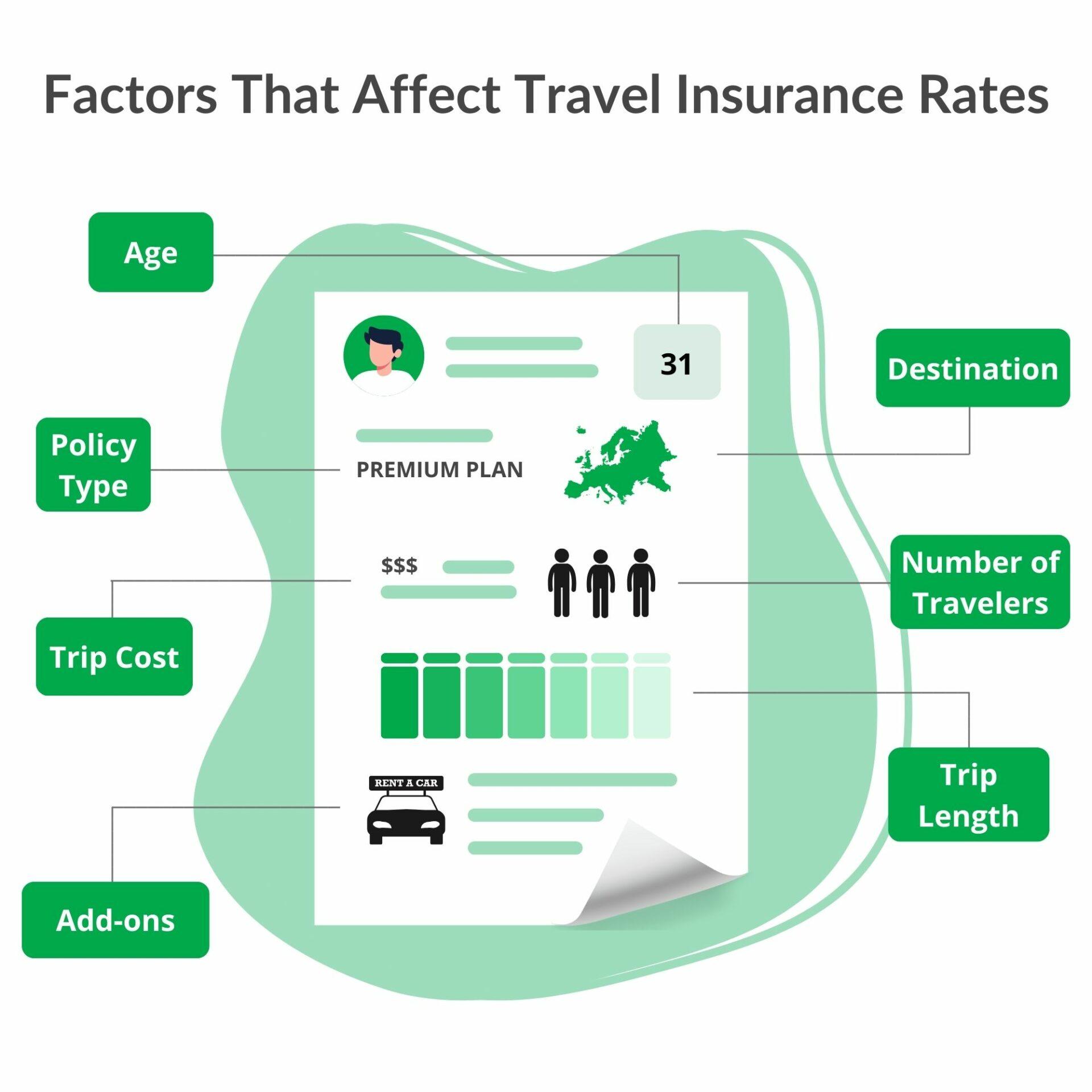

When considering points-based travel insurance, several factors come into play to determine its reliability. Policy coverage is a primary concern, as it varies significantly among providers. Some plans may offer comprehensive protection, including trip cancellations, medical emergencies, and lost baggage, while others might provide limited benefits. It’s crucial to scrutinize the fine print to ensure that the coverage aligns with your travel needs. Additionally, the ease of redemption is another critical factor. A policy that appears beneficial but involves a cumbersome redemption process may not be practical, especially in emergency situations.

Another aspect to evaluate is the customer service and claims process. Feedback from other travelers can be invaluable, shedding light on the responsiveness and efficiency of an insurer in handling claims. A reliable insurance policy should ideally have a straightforward, user-friendly claims process, with minimal bureaucratic hurdles. Furthermore, consider the reputation of the insurer. Established companies with a track record of customer satisfaction are often more dependable. Ultimately, assessing these elements can help in determining the reliability of points-based travel insurance, ensuring peace of mind during your travels.

Key Considerations When Choosing Travel Insurance with Points

When selecting travel insurance purchased with points, there are several critical factors to evaluate to ensure you’re adequately covered. First, it’s essential to assess the coverage limitations associated with using points rather than cash. Policies bought with points may sometimes offer reduced benefits or higher deductibles, potentially impacting your overall protection. Additionally, verify if the insurance provider offers a comprehensive range of coverage options, including trip cancellations, medical emergencies, and lost luggage, to ensure all potential risks are mitigated.

Consider the flexibility of the policy. Some travel insurance plans might have restrictions on changes or cancellations when points are used, which could limit your ability to adjust your travel plans without incurring extra costs. Moreover, scrutinize the claim process for policies purchased with points. It’s crucial to understand how easy it is to file a claim and what documentation is required, as this can vary significantly from traditional policies. Lastly, check if there are any additional fees or charges when redeeming points for travel insurance, which could affect the overall value of your points.

- Coverage limitations with points

- Comprehensive range of options

- Policy flexibility

- Claim process scrutiny

- Additional fees or charges

Expert Recommendations for Maximizing Benefits with Points-Based Travel Insurance

To make the most out of points-based travel insurance, industry experts suggest focusing on a few key strategies. Firstly, compare multiple policies to understand the range of benefits offered in exchange for points. Different providers often have unique point redemption systems and varying coverage levels, so it’s essential to find a policy that aligns with your travel needs. Additionally, ensure that you read the fine print to be aware of any limitations or exclusions that could affect your coverage.

Experts also recommend timely redemption of points to maximize their value. Many points-based systems offer bonuses or enhanced benefits if redeemed well in advance of your travel dates. Furthermore, maintaining an organized record of your points can help in tracking their expiration and planning future redemptions strategically. Another tip is to leverage customer reviews and forums for insights on the actual experiences of other travelers with similar policies. This real-world feedback can be invaluable in assessing the reliability and effectiveness of a points-based travel insurance policy.