In the realm of modern travel, where digital convenience meets wanderlust, the allure of credit card points gleams like a beacon of possibility. For many, these points are the golden tickets to a world of discounted flights, luxurious hotel stays, and exclusive experiences. But as travelers increasingly navigate the intricate web of loyalty programs and reward systems, a question quietly echoes through airport lounges and travel forums: Are credit card points truly the key to unlocking extraordinary journeys, or are they an overrated currency in the world of travel? In this exploration, we delve into the promise and the pitfalls of credit card points, unraveling the myths and realities to discover if they truly live up to their glittering reputation.

Unlocking the Truth Behind Travel Rewards

In the realm of travel rewards, credit card points are often heralded as the golden ticket to luxury vacations and discounted trips. Yet, the reality is more nuanced. While these points can indeed offer significant value, their benefits can sometimes be clouded by the complexities of redemption processes and fluctuating point values. Understanding the real worth of your points is crucial to avoid the common pitfall of overspending to accumulate rewards that might not equate to their perceived value.

- Redemption Restrictions: Many programs have blackout dates, limited seat availability, or require an extensive amount of points for premium travel experiences.

- Devaluation Risks: Points can lose value over time, and frequent program changes can impact the worth of accumulated points.

- Opportunity Cost: Focusing on points might divert attention from more straightforward, cost-effective travel deals available through other means.

For travelers aiming to maximize their rewards, it’s essential to stay informed and flexible, adapting to the ever-evolving landscape of travel loyalty programs. By strategically using credit card points, savvy travelers can still unlock unique travel experiences, but it’s a journey that requires careful planning and a discerning eye.

The Hidden Costs of Points and Miles

While the allure of collecting points and miles can be tantalizing, it’s essential to consider the often-overlooked expenses that accompany these rewards. Many credit cards with travel perks come with annual fees that can range from moderate to exorbitant. Additionally, there are opportunity costs involved; by focusing on maximizing points, consumers might overlook more straightforward cash-back options that could offer more immediate and tangible benefits.

- Redemption Restrictions: Blackout dates and limited availability can make it challenging to use points when you actually want to travel.

- Devaluation of Points: Airlines and hotels can devalue points with little notice, diminishing the value of your accumulated rewards.

- Foreign Transaction Fees: Not all travel cards waive these fees, which can add up during international trips.

Moreover, the psychological impact of points accumulation can sometimes lead to overspending as users chase rewards, inadvertently negating any perceived benefits. A careful analysis of your spending habits and travel needs is crucial to ensure that you’re not sacrificing financial health for the allure of “free” travel.

Maximizing Your Travel Benefits Wisely

Travel enthusiasts often ponder whether credit card points genuinely elevate their travel experiences or merely create an illusion of value. While these rewards can unlock significant benefits, it’s crucial to navigate the complexities with a strategic mindset. Here are some tips to ensure you are truly maximizing your travel benefits:

- Understand the Conversion Rates: Not all points are created equal. Evaluate the conversion rates and redemption options to ensure you’re receiving the best value.

- Leverage Sign-Up Bonuses: Many cards offer generous sign-up bonuses. Plan your spending to meet these requirements without unnecessary expenses.

- Stay Informed: Terms and conditions can change. Regularly review your card’s reward program to stay updated on any alterations that might impact your travel plans.

By aligning your credit card strategy with your travel goals, you can unlock a world of opportunities without falling into the trap of overvaluing points. Remember, the key is to remain flexible and informed.

Expert Tips for Savvy Credit Card Use

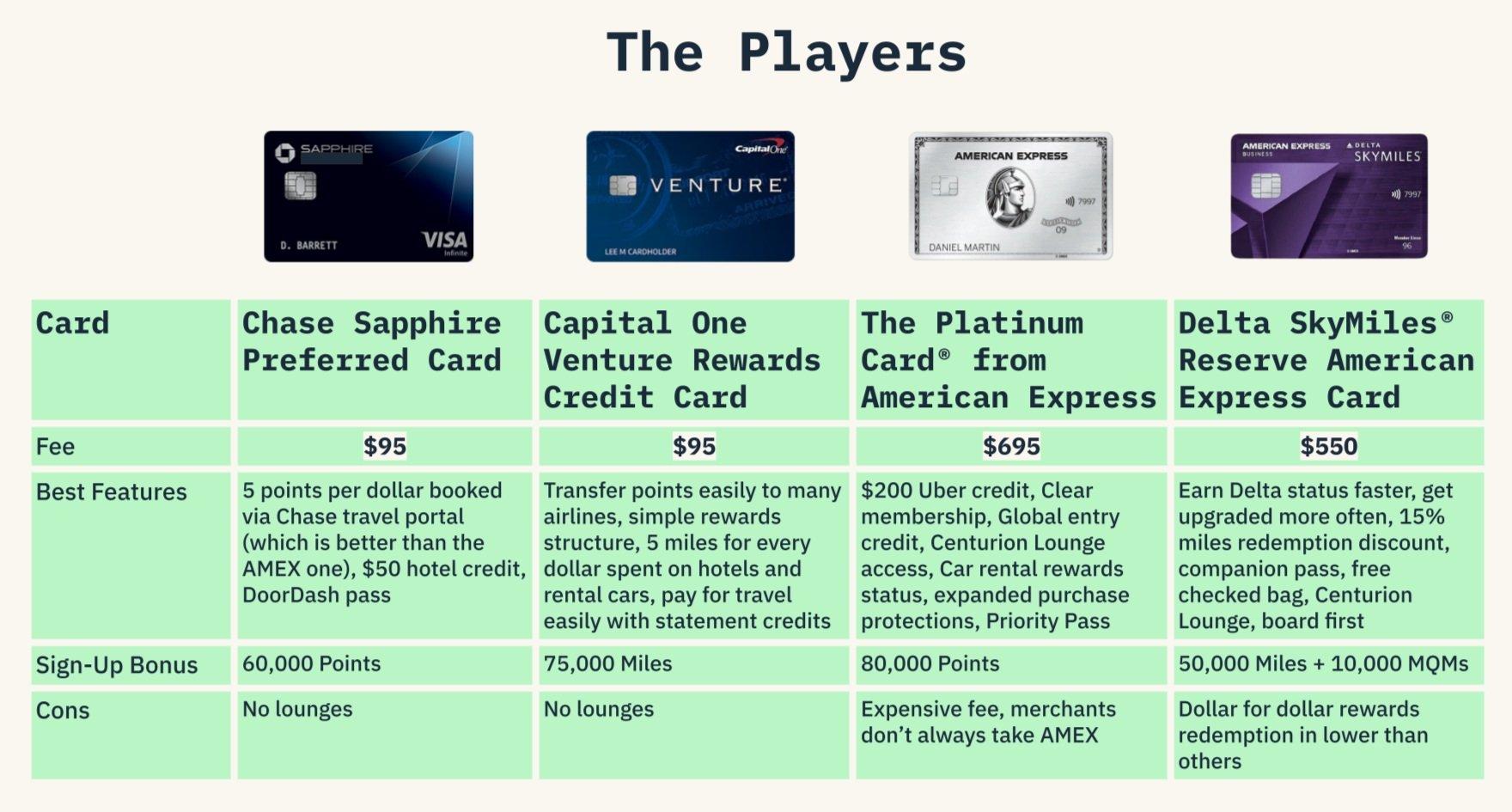

- Maximize Your Rewards: Not all credit cards are created equal when it comes to travel rewards. Look for cards that offer higher points for travel-related purchases like flights, hotels, and car rentals. It’s crucial to align your spending habits with the card’s reward structure to truly benefit.

- Understand the Redemption Process: Many cardholders find themselves disillusioned with points because they don’t fully grasp the redemption process. Familiarize yourself with transfer partners, blackout dates, and point value to ensure you’re getting the best deal when you book your next getaway.

- Consider the Fees: While some cards boast impressive reward programs, they might come with hefty annual fees. Weigh the benefits against these costs, especially if you’re not a frequent traveler, to determine if the rewards justify the expense.

- Keep an Eye on Expiration: Points can lose their value or even expire if left unused for too long. Regularly check your balance and redemption options to avoid missing out on your hard-earned rewards.