In the ever-evolving world of travel, where adventure beckons from every corner of the globe, nothing quite dampens the spirit of exploration like the unexpected sting of foreign transaction fees. These stealthy charges, lurking in the fine print of your credit card statement, can turn a dream vacation into a financial headache. But fear not, intrepid traveler, for there exists a savvy solution to this modern-day conundrum: the travel card. In this article, we will embark on a journey through the labyrinth of financial products designed to help you sidestep those pesky fees. Whether you’re a seasoned globetrotter or a novice explorer, you’ll discover practical tips and insights on how to make the most of your travel card, ensuring your adventures remain as enriching as the cultures you encounter. So, pack your bags, grab your passport, and let’s delve into the world of fee-free travel, where your budget stays as unspoiled as your wanderlust.

Understanding Foreign Transaction Fees

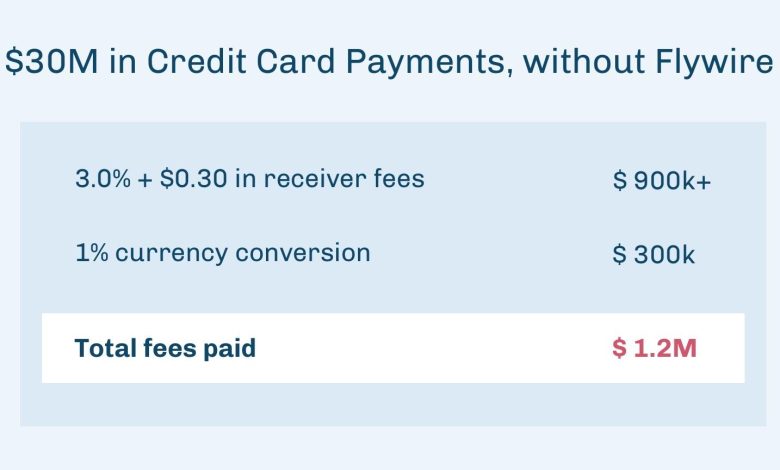

When traveling abroad, it’s essential to grasp the intricacies of fees imposed on foreign transactions. These fees, often hidden in the fine print, can surprise travelers who are not well-prepared. Essentially, these charges are applied by your bank or credit card issuer when you make a purchase in a currency different from your own. Typically, they range from 1% to 3% of the transaction amount. This might seem small at first glance, but can quickly add up over the course of a trip.

- Currency Conversion Fees: These are charges for converting your purchase into your home currency.

- Issuer Fees: Some credit card companies add their own fees on top of the conversion fees.

Understanding these fees helps in making informed decisions about which cards to use while traveling. By selecting travel cards that waive these fees, you can enjoy your adventures without the added financial burden.

Choosing the Right Travel Card for Your Needs

When embarking on your next adventure abroad, selecting the ideal travel card can make all the difference in managing your finances efficiently. Look for a card that offers no foreign transaction fees, as these charges can quickly add up with every swipe. Consider cards that provide benefits such as:

- Global Acceptance: Ensure the card is widely accepted in your travel destinations, minimizing the hassle of carrying cash.

- Competitive Exchange Rates: Some cards offer better currency conversion rates than others, helping you save on every purchase.

- Travel Perks: Look for additional benefits like travel insurance, airport lounge access, and rewards points that can be redeemed for flights or hotel stays.

It’s also crucial to review the card’s annual fees and any additional charges that may apply, ensuring they align with your travel frequency and budget. By carefully analyzing these features, you can find a travel card that not only saves you money but also enhances your overall travel experience.

Maximizing Benefits and Rewards

Unlocking the full potential of your travel card is all about strategically leveraging its features. Start by exploring the card’s reward structure. Many cards offer generous points or miles for travel-related purchases, dining, and even everyday expenses. Understanding these categories can help you maximize your rewards. Consider using your card for hotel bookings, flights, and dining out to earn the most points. Some cards even offer bonus points for specific merchants or during promotional periods, so staying informed about these opportunities is crucial.

- Sign-up bonuses: Make sure to take advantage of any sign-up bonuses by meeting the spending requirements within the specified timeframe.

- Loyalty programs: Enroll in loyalty programs offered by airlines or hotel chains that partner with your card to double-dip on rewards.

- Purchase protections: Utilize purchase protection benefits for big-ticket items bought abroad, ensuring peace of mind.

Moreover, some travel cards offer perks like airport lounge access, free checked bags, or travel insurance. Taking full advantage of these perks not only enhances your travel experience but also adds value to your card usage. By understanding and effectively utilizing these benefits, you can significantly offset the cost of foreign transaction fees, making your travel card an indispensable travel companion.

Practical Tips for Fee-Free Travel

Traveling without the burden of foreign transaction fees is easier than you might think. Start by choosing a credit card specifically designed for international use. Many cards offer zero foreign transaction fees, allowing you to make purchases abroad without incurring extra charges. When selecting a card, consider those that also provide travel rewards or cashback benefits, adding even more value to your journey.

- Research your options: Look for cards that emphasize fee-free international transactions.

- Check for hidden fees: Ensure there are no annual fees or other charges that could offset your savings.

- Explore additional perks: Some cards offer travel insurance, purchase protection, or airport lounge access.

Once you’ve found the right card, make sure to notify your bank of your travel plans to avoid any disruptions. Additionally, carry a small amount of local currency for places that might not accept cards. With the right preparation, you can enjoy your travels without worrying about extra costs sneaking onto your bill.