In today’s competitive financial landscape, credit cards have evolved beyond mere tools for transactions, offering a plethora of rewards and benefits tailored to diverse consumer needs. Among these perks, free hotel stays have emerged as a highly sought-after incentive, especially for avid travelers and frequent business commuters. This article delves into the intricate world of credit cards that prioritize hotel rewards, providing a comprehensive analysis of the best options available for securing complimentary accommodations. By examining the key features, rewards structures, and potential drawbacks of these cards, we aim to equip readers with the knowledge necessary to make informed decisions that align with their travel and financial goals. Whether you’re planning a luxurious getaway or simply seeking to maximize your travel budget, understanding the nuances of these credit card offerings is crucial in leveraging them to their full potential.

Top Features to Look for in Hotel Rewards Credit Cards

When exploring hotel rewards credit cards, it’s essential to evaluate the earning potential they offer. Cards that provide higher points per dollar spent on hotel stays and related travel expenses can accelerate your path to free nights. Additionally, consider cards that include welcome bonuses as they can provide a substantial boost to your points balance right from the start.

Another key aspect is the redemption flexibility. Look for cards that allow you to use your points at a wide range of hotel brands or even transfer points to airline partners. This flexibility can maximize the value of your rewards. Moreover, pay attention to annual fees and additional perks such as complimentary room upgrades, late check-out, and free breakfast, which can enhance your travel experience. Lastly, ensure the card offers strong customer support and travel protections, such as trip cancellation insurance and baggage delay coverage, for peace of mind during your travels.

Comparing the Leading Credit Cards for Hotel Stays

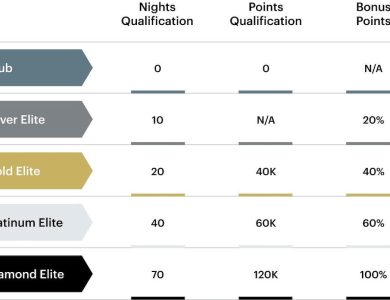

When it comes to maximizing your rewards for hotel stays, several credit cards stand out due to their lucrative benefits and strategic partnerships with hotel chains. These cards often offer generous welcome bonuses, exclusive elite status, and significant points per dollar spent on hotel bookings, making them ideal for frequent travelers.

- Chase Sapphire Preferred® Card: Known for its versatile reward structure, this card offers valuable points for travel and dining purchases, which can be transferred to hotel partners like Hyatt, Marriott, and IHG.

- American Express® Gold Card: With its strong points earning on dining and groceries, this card also allows transfers to a variety of hotel loyalty programs, giving you flexibility in choosing your stay.

- Hilton Honors American Express Surpass® Card: Ideal for Hilton enthusiasts, this card provides complimentary Gold Status and offers high points earning on Hilton purchases.

- Marriott Bonvoy Boundless® Credit Card: Tailored for Marriott loyalists, it offers a free night award every year and bonus points on Marriott stays, enhancing your travel experience.

Each of these cards provides distinct advantages tailored to different types of travelers. Consider your preferred hotel chain and travel habits to select the card that aligns best with your needs. Remember, the key to maximizing benefits lies in strategic usage, from booking directly with hotels to utilizing transfer partners effectively.

How to Maximize Your Hotel Rewards Points

To truly benefit from your hotel rewards, it’s essential to understand how to strategically accumulate and redeem your points. Choosing the right credit card can significantly impact your ability to earn points quickly. Look for cards that offer generous sign-up bonuses and rewards rates on hotel stays. Additionally, some cards provide extra points for dining, travel, or everyday purchases, allowing you to earn more even when you’re not traveling.

- Sign-Up Bonuses: Opt for cards that offer substantial sign-up bonuses. These can sometimes be enough for a free night or two at select hotels.

- Category Bonuses: Use cards that give bonus points for hotel stays and related travel expenses.

- Partnerships: Take advantage of cards that have partnerships with specific hotel chains, as these often provide additional perks like room upgrades or late check-out.

- Loyalty Program Membership: Enroll in hotel loyalty programs to earn points directly from your stays, which can often be combined with credit card rewards.

It’s also wise to keep an eye on promotional offers from your credit card issuer and hotel loyalty programs, as these can provide opportunities to earn bonus points. Remember, the key to maximizing your rewards is consistent use and strategic redemption. By leveraging the right tools and offers, you can enjoy more free nights and enhanced travel experiences.

Expert Recommendations for the Best Hotel Credit Cards

When it comes to maximizing your hotel stays, selecting the right credit card can be a game-changer. Travel experts often highlight cards that offer a combination of high reward rates, flexible redemption options, and exclusive perks. Look for cards that provide a substantial sign-up bonus and ongoing benefits like complimentary elite status, which can enhance your stay with room upgrades and late check-outs.

- Flexible Points Redemption: Cards that allow you to transfer points to various hotel loyalty programs give you the versatility to choose from a wide range of properties worldwide.

- Annual Free Night Certificate: Some cards offer a free night each year, which can offset the annual fee and provide great value if used at a high-end hotel.

- Travel Protections: Comprehensive travel insurance, trip cancellation coverage, and lost luggage reimbursement can add peace of mind to your travels.

In addition to these features, experts suggest considering your travel habits. If you frequently stay with a specific hotel chain, a co-branded card might offer the best rewards and elite status benefits. Ultimately, the ideal card will align with your travel goals and provide the greatest return on your spending.