In an increasingly interconnected world, leveraging credit card offers for travel upgrades has become a strategic tool for savvy travelers seeking to enhance their experiences without incurring significant additional costs. This article delves into the mechanics of credit card rewards programs, exploring how consumers can effectively utilize these offers to secure upgrades such as business class flights, luxury hotel stays, and exclusive access to airport lounges. By analyzing the various types of credit card incentives available, from sign-up bonuses to reward point systems, we aim to provide a comprehensive guide that empowers travelers to make informed decisions. Through an examination of case studies and expert insights, we will unravel the complexities of credit card offers, offering practical advice on how to maximize benefits while navigating potential pitfalls.

Understanding the Basics of Credit Card Rewards Programs

Credit card rewards programs can be a valuable tool for travelers looking to enhance their experiences without breaking the bank. These programs often offer a variety of perks that can be leveraged for travel upgrades, including bonus points, cashback, and exclusive travel benefits. Understanding how to navigate these rewards can transform your travel plans. Begin by identifying credit cards that offer rewards tailored to your travel preferences, such as those providing points for airline miles or hotel stays.

- Airline Miles: Many credit cards offer miles for every dollar spent, which can be redeemed for flight upgrades or even free tickets.

- Hotel Points: Accumulate points that can be used for free nights or room upgrades at partnered hotels.

- Cashback Offers: Use cashback rewards to offset travel expenses or invest in additional amenities during your trip.

- Exclusive Access: Some cards provide access to airport lounges or priority boarding, enhancing your travel comfort.

To maximize these benefits, keep track of your spending and pay off your balance in full each month to avoid interest charges that can negate the value of your rewards. Additionally, familiarize yourself with the terms and conditions of each program to ensure you are making the most of your credit card offers.

Maximizing Points and Miles for Travel Perks

Unlocking the full potential of your credit card offers can transform your travel experience from ordinary to extraordinary. Start by focusing on cards that offer sign-up bonuses, as these can provide a substantial boost to your points and miles balance. Keep an eye out for promotions that align with your travel goals, such as double points on airfare or hotel stays. Additionally, many cards offer bonus points for specific categories like dining and groceries, which can accelerate your earnings.

- Frequent Flyer Programs: Pair your credit card with an airline’s loyalty program to multiply your benefits. Many cards allow you to transfer points directly to these programs.

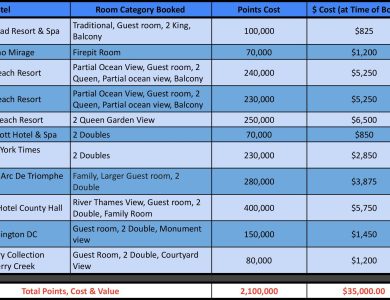

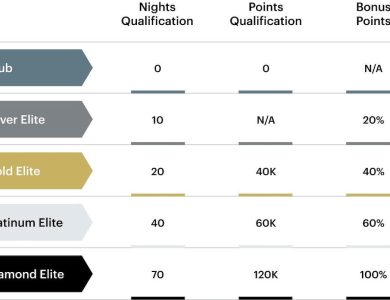

- Hotel Loyalty Schemes: Consider cards that partner with hotel chains, offering perks like free nights, room upgrades, and late check-outs.

- Travel Portals: Some cards have their own booking platforms where you can redeem points for travel, often with added discounts or bonuses.

Furthermore, leveraging category bonuses and strategic spending can maximize your rewards. For instance, if a card offers triple points on travel purchases, plan to book your flights and accommodations through that card. Regularly reviewing your spending habits and adjusting your card usage accordingly ensures that you are consistently earning at the highest possible rate. By carefully selecting and using your credit card offers, you can enjoy a wide array of travel upgrades without incurring additional costs.

Evaluating the Best Credit Cards for Travel Upgrades

When considering credit cards for travel upgrades, it’s crucial to assess the benefits and features each card offers. Many premium cards provide access to airport lounges, complimentary checked bags, and priority boarding. However, the true value often lies in the details. Consider the following features when evaluating your options:

- Sign-up Bonuses: Some cards offer substantial bonuses that can be redeemed for upgrades. Ensure you understand the spending requirements to qualify.

- Point Conversion Rates: Examine how points or miles can be converted into upgrades. Some cards offer better conversion rates for specific airlines or hotel chains.

- Annual Fees vs. Benefits: Weigh the annual fee against the benefits provided. A higher fee might be justified if it includes significant travel perks.

- Partnerships: Cards with partnerships can offer enhanced upgrade options. Look for cards that partner with airlines or hotels you frequently use.

By focusing on these key aspects, you can make a more informed decision and select a credit card that maximizes your travel upgrade potential.

Strategic Tips for Redeeming Offers and Enhancing Travel Experiences

To maximize the value of credit card offers, it’s essential to be strategic. Begin by prioritizing cards that align with your travel goals, whether that’s earning points for flights, accessing airport lounges, or receiving complimentary hotel stays. Many credit cards come with sign-up bonuses, so ensure you meet the spending requirements within the stipulated time to unlock these benefits.

- Research Transfer Partners: Not all points are created equal. By understanding which airlines or hotels are partners with your credit card, you can transfer points to programs that offer better redemption value.

- Monitor Promotions: Regularly check for promotions that can multiply your points on specific categories like dining or travel purchases. This will accelerate your points accumulation and get you closer to an upgrade.

- Leverage Concierge Services: Many premium cards offer concierge services that can assist in securing upgrades or reservations at sought-after venues, enhancing your travel experience.

By staying informed and leveraging the full spectrum of benefits your credit card offers, you can transform your travel experiences from ordinary to extraordinary. Make it a habit to regularly review your card’s benefits and stay updated on any changes or new offers that could further enhance your travel adventures.