In an era where travel has become more accessible than ever, discerning travelers are constantly seeking ways to enhance their experiences without incurring exorbitant costs. Credit cards, often seen merely as financial tools for managing expenses, have evolved into gateways for unlocking a plethora of exclusive travel benefits. From priority boarding and lounge access to complimentary hotel upgrades and concierge services, the strategic use of credit cards can transform ordinary travel into a VIP experience. This article delves into the analytical intricacies of leveraging credit card perks to elevate your travel, offering insights into how savvy consumers can maximize these benefits while navigating potential pitfalls. By understanding the nuances of credit card offerings and aligning them with your travel goals, you can enjoy a premium travel lifestyle without breaking the bank.

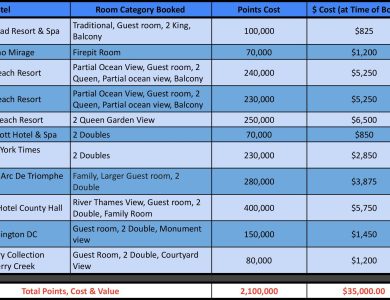

Maximizing Rewards Points for Premium Travel Benefits

Unlocking the full potential of your credit card rewards requires a strategic approach. First, focus on cards that offer generous sign-up bonuses and ongoing rewards in categories that match your spending habits. This could mean opting for a card that offers extra points on travel-related expenses, dining, or even everyday purchases like groceries. Remember, many premium cards also come with hefty annual fees, but the benefits often outweigh the costs if you leverage them effectively. For example, free airport lounge access, complimentary travel insurance, and exclusive hotel upgrades can significantly enhance your travel experience without additional expenses.

Another strategy is to consolidate your spending on a few select cards to maximize point accumulation. Look for opportunities to earn additional points through special promotions or partnerships. Additionally, consider transferring your points to travel partners, such as airlines or hotel chains, where they often hold more value. Be mindful of expiration dates and redemption restrictions to avoid losing out on these benefits. By carefully managing and redeeming your rewards, you can enjoy luxurious travel experiences at a fraction of the cost.

Navigating Airline and Hotel Loyalty Programs with Credit Cards

Unlocking the full potential of airline and hotel loyalty programs often requires a strategic approach, especially when leveraging credit cards. Many travel credit cards offer exclusive perks that can significantly enhance your travel experience. By aligning your spending habits with the right credit card, you can accrue points or miles faster, often through bonus categories like dining or travel-related purchases. This not only accelerates your journey to elite status but also opens doors to amenities like complimentary room upgrades, priority boarding, and access to premium lounges.

To effectively navigate these programs, it’s crucial to understand the synergy between your credit card and the loyalty programs you’re enrolled in. Look for cards that offer transferable points to multiple airline and hotel partners, allowing for greater flexibility in redeeming rewards. Additionally, many cards provide annual free nights or companion tickets, which can be a significant value booster. Consider the following strategies to maximize benefits:

- Choose a card that aligns with your preferred airline or hotel chain to maximize reward accumulation.

- Utilize introductory bonuses by meeting spending requirements within the designated timeframe.

- Take advantage of co-branded cards that offer automatic elite status, which can lead to additional perks.

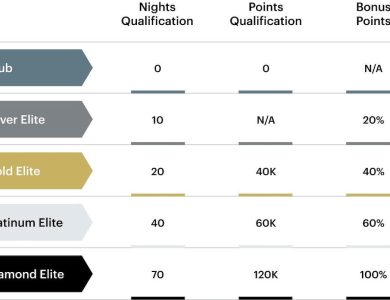

Understanding Annual Fees and Interest Rates for Optimal Value

When it comes to maximizing the value of your credit card for VIP travel perks, understanding the dynamics of annual fees and interest rates is crucial. Credit cards that offer exclusive travel benefits often come with higher annual fees, which might seem daunting at first. However, these fees can be justified by the range of privileges they unlock, such as access to airport lounges, priority boarding, or complimentary travel insurance. The key is to assess whether the perks align with your travel habits and if the value they provide outweighs the cost of the fee. Consider factors such as:

- Frequency of travel and potential savings on amenities

- Extent of travel-related benefits provided

- Additional cardholder perks that might enhance your travel experience

Interest rates, on the other hand, come into play if you carry a balance from month to month. While some premium cards offer competitive rates, the best strategy is to pay off your balance in full to avoid interest charges altogether. This approach ensures that the value of travel perks isn’t diminished by accruing interest costs. For those who manage their credit responsibly, the focus should remain on leveraging the benefits rather than incurring unnecessary charges. By doing so, you can enjoy a luxurious travel experience without financial setbacks.

Strategic Use of Credit Card Offers for Exclusive Travel Experiences

In the realm of luxury travel, credit card offers can be your gateway to an elevated experience. By strategically leveraging the right cards, travelers can access a suite of VIP perks that transform a standard trip into an extraordinary adventure. Many premium credit cards offer benefits such as complimentary airport lounge access, room upgrades, and exclusive concierge services. The key is to identify which cards align with your travel goals and maximize their offerings. For instance, some cards provide automatic elite status with major hotel chains, while others might offer significant discounts on first-class tickets.

- Airport Lounge Access: Escape the crowds and enjoy complimentary refreshments, Wi-Fi, and comfortable seating before your flight.

- Hotel Room Upgrades: Experience enhanced comfort and luxury with upgrades that include better views, larger rooms, or additional amenities.

- Travel Insurance: Benefit from peace of mind with coverage for trip cancellations, lost luggage, and medical emergencies.

- Concierge Services: Gain access to personalized assistance for booking reservations, securing tickets to exclusive events, and more.

By selecting credit cards that offer these perks, and using them effectively, you can unlock a world of premium travel experiences without the premium price tag. Remember, the most successful strategy is to align your card choices with your travel habits and preferences, ensuring you reap the maximum benefits while embarking on your next adventure.